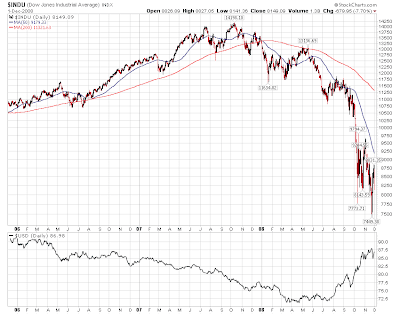

Apple and Goldman Sachs are two large cap names that have outperformed

SPX by more than

70% YTD.

Both

AAPL and

GS have rallied back to pre-crisis levels.

(AAPL in unrelenting uptrend while both XLK and GOOG vs. SPX are trading relatively sideways)

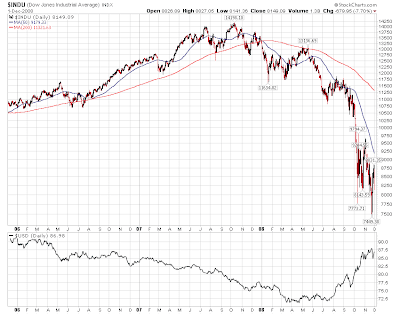

Perhaps these names are in their own worlds. Other indicators of paper assets, such as

XLF relative to SPX and

GBP, have been losing upside momentum of late.

I am closely watching whether GS and AAPL continue their leadership as confirmation that the broad market uptrend is intact.